Helping homebuyers understand new mortgage forms

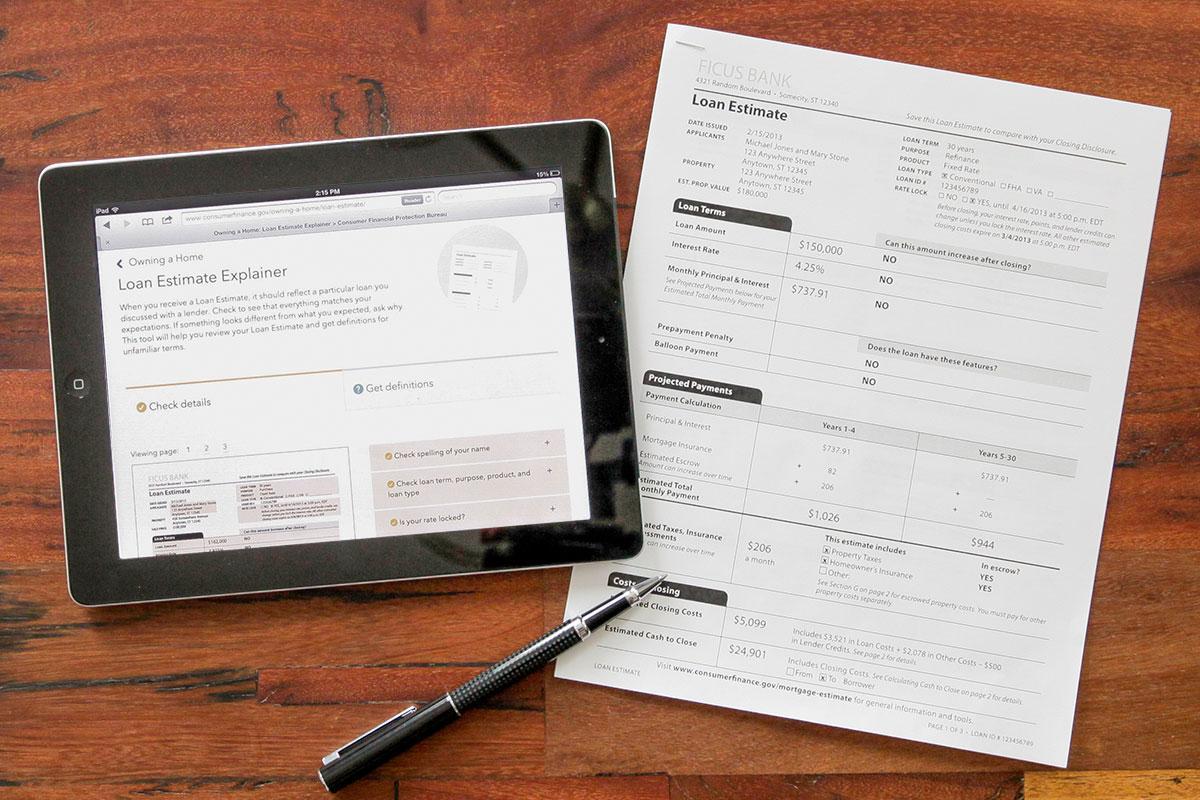

On the right, the new Loan Estimate form. On the left, a web page

that helps to explain it.

On the right, the new Loan Estimate form. On the left, a web page

that helps to explain it.

Starting October 3, homebuyers will see two new forms during the mortgage process. One, the Loan Estimate, will help consumers understand the estimated costs and conditions of every mortgage they consider. The other, the Closing Disclosure, will give consumers a final overview of their mortgage terms at closing.

Both forms were designed by the CFPB to be clear, concise, and consumer friendly. We put the forms through several rounds of user testing to make sure the average homebuyer can understand the often complex terms and calculations shown on both forms.

But we know that no form can possibly answer every question homebuyers will have about their mortgage, so we went one extra step. Both forms feature a URL that homebuyers can visit to get help understanding the forms.

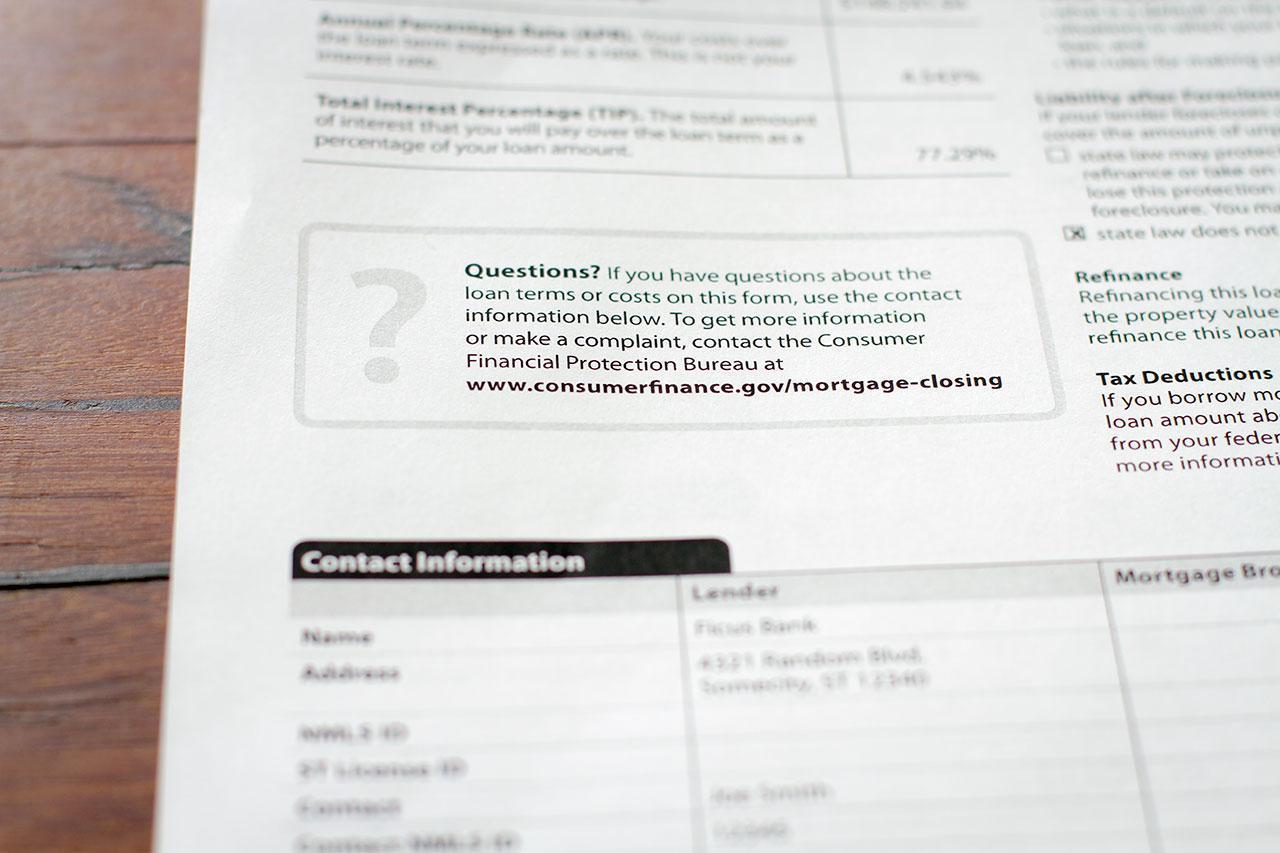

The URL on a paper Loan Estimate form.

The URL on a paper Loan Estimate form.

Those URLs point to a set of tools that help answer consumers’ questions about the forms. These tools went through a design and usability testing process, and we’re super excited to launch them right alongside the forms on October 3.

Design

When we started designing these tools, we had a very clear use case in mind: a homebuyer with a form in one hand and a mouse in the other.

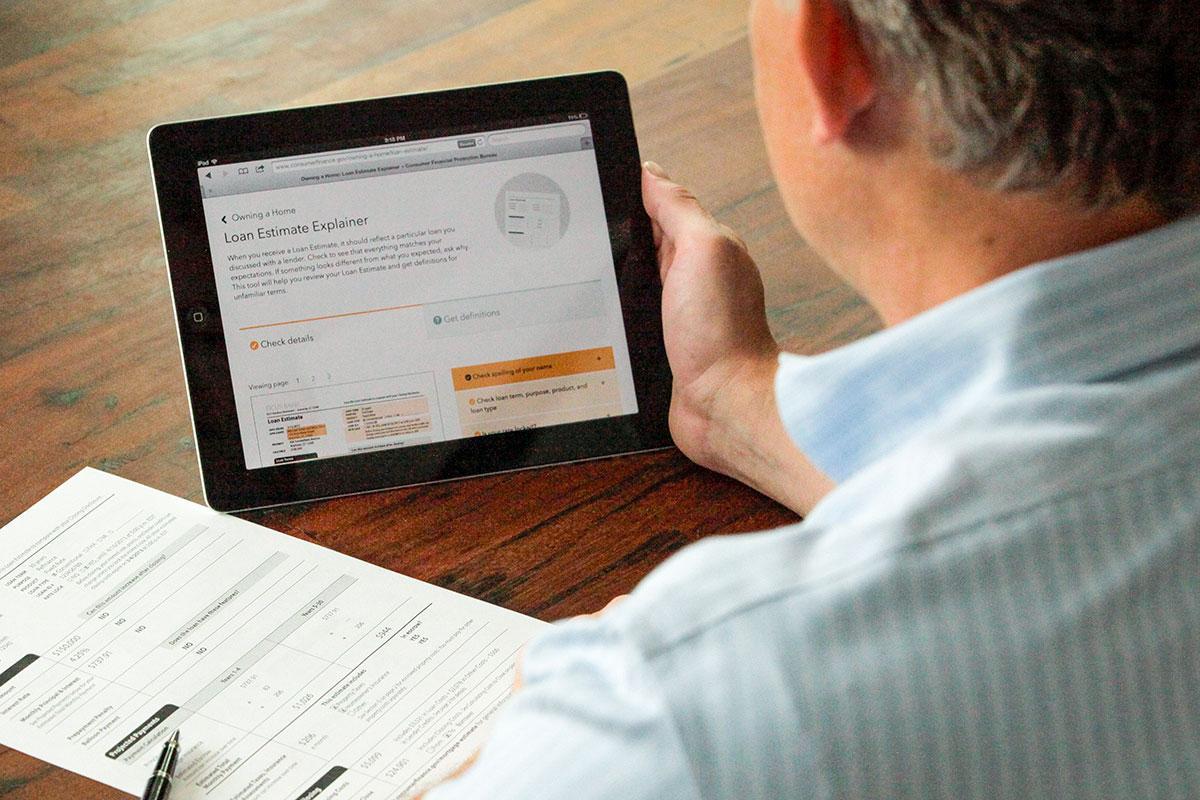

A

homebuyer looking at both the paper form and the web page that explains it.

A

homebuyer looking at both the paper form and the web page that explains it.

Though the specifics of the situation might change (the form might be a PDF open in a browser tab or the mouse might be a tablet), the big idea is the same: most of our users are going to be looking for help with a specific part of their form by looking for a specific part of their form.

That’s why we designed the interface with the forms themselves front and center on screens of all sizes.

Thanks to previous work on the Owning a Home project, we had lots of research to guide us on what parts of the form might be confusing and what homebuyers need to watch out for (e.g., making sure the address listed on the form is exactly correct). Those areas are all highlighted in the Loan Estimate and Closing Disclosure tools, and a quick click or tap pulls up info that helps answer homebuyers’ questions.

The Closing Disclosure tool also highlights areas of that form that homebuyers should compare to their original Loan Estimate form to see if any mortgage costs or conditions have changed (the forms were specifically designed to be compared side by side). The tool helps homebuyers understand what changes are allowed under current mortgage regulations.

We tested the tools with potential homebuyers to make sure our design made sense. Those users helped us see issues we wouldn’t have spotted otherwise, like how confusing it was to lump simple definitions of terms on the form in with more complex explanations of what to watch out for. That kind of usability testing data let us continuously refine the tools’ interface.

Technology

The universe of forms that need explaining isn’t limited to Loan Estimates and Closing Disclosures. Those may be the particular forms we’ll be explaining on October 3, but we built the technology to be flexible enough to handle just about any kind of form.

There are three things needed to explain most paper forms on the web: an image of each form page, content explaining the different parts of the form, and a map that ties the part of the form to be explained to the correct piece of content. Together, those three things can create an interface that shows the form with hotspots positioned over each part to be explained. Tapping or clicking those hotspots shows the associated content.

Our tools use an HTML file for each page of the form to be explained. That file

contains only a data object with two properties, img and terms. For

example:

data = {

"img": url_for('static', filename='img/form-page.png'),

"terms":

[

{

"term": "Estimated Closing Costs",

"definition": "<p>Upfront costs you will be charged to get your loan and

transfer ownership of the property.</p>",

"id": "estimated-closing",

"category": "definitions",

"left": "6.95%",

"top": "85.20%",

"width": "23.26%",

"height": "4.39%"

}

/* The rest of the terms being explained */

]

}

The img property is just a path to the image file of the form page being

explained. The terms array is where the real action happens. It contains all

the information needed to explain a particular part of the form, like the name,

definition, and position of the explained part.

Structuring explainer pages like this gives a couple of benefits. First, all the content is in one chunk, so pages can be created and edited without digging through masses of HTML. Even better, though, is how the simple structure of the data lets non-technical folks write and tweak definitions without needing to understand anything more than very simple HTML.

We’re excited to launch our new Loan Estimate and Closing Disclosure tools on October 3. We’re just as excited about the future of the form explainer concept. Like much of our work at the CFPB, the code for these tools is open source and free for anyone to use or adapt for their own projects. The code is all on GitHub, and we’d love to see it used and improved.