Updated Owning a Home tool guides users through home-buying process

Today we’re releasing improvements to our Owning a Home suite of tools and resources. Owning a Home helps consumers decide what kind of loan they want to get, choose the deal that’s right for them, and close with confidence. We help consumers spot red flags and ask the right questions throughout their home-buying journey. And now we’ve designed a user-friendly guide to help consumers prepare for and navigate the home-buying process, from start to finish.

The Owning a Home site demystifies mortgage jargon, provides mortgage shoppers with detailed information on loan options, and makes a closing checklist and guide to closing forms available for download to help them at the closing table. Our previous site helped consumers learn the range of interest rates they can expect. What was missing was a clear context for all of these tools: when should home buyers access them, and what else should they be thinking of when interacting with all this information?

During our interviews with homebuyers, we found that consumers don’t always have a clear understanding of the process of buying a home. They desired clear action steps and milestones along the way, from preparing to shop for a mortgage to closing.

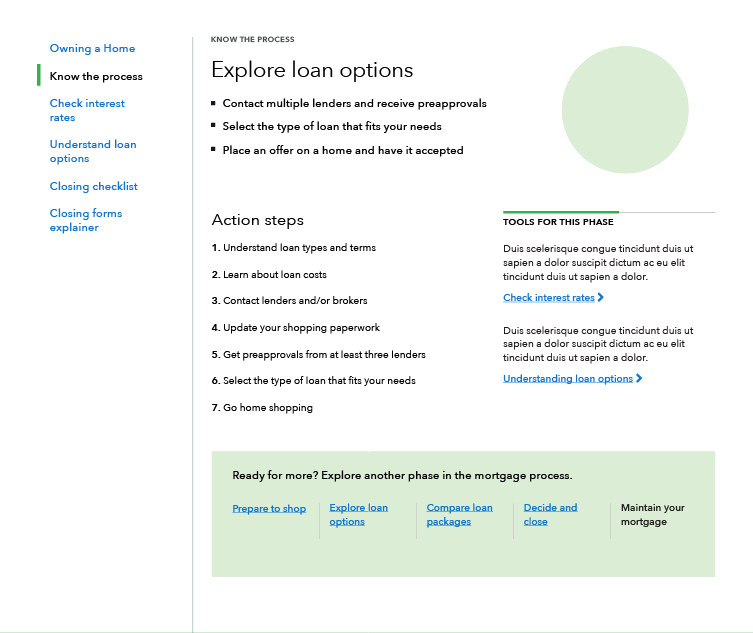

Owning a Home now addresses this need by presenting an overview of the home-buying process, broken down into four phases. Users can navigate the Owning a Home site depending on which phase they’re at in the process: preparing to shop, exploring loan choices, comparing loan offers, and getting ready to close. Each phase contains three main goals and clearly defined action steps to accomplish those goals, helping home buyers understand and move confidently through the process to own a home.

The four phases help consumers as they move through the process:

- Prepare to shop helps home buyers determine how much they can afford to spend on a home, decide if it’s the right time to buy a new home, and gather the application paperwork they need.

- Explore loan choices helps homebuyers understand the different kinds of loans and select one that fits their needs, so they’ll be prepared to request Loan Estimate forms.

- Compare loan offers guides homebuyers through requesting Loan Estimates from multiple lenders, comparing different Loan Estimates, and choosing an offer.

- Get ready to close supports home buyers after they’ve found a home and chosen a specific mortgage loan and lender. It guides them through submitting documents, choosing closing service providers, and closing on the home and loan.

With this guide, we had three main goals:

- Provide a high-level overview of the mortgage process,

- Offer the benchmarks homebuyers said they lack, and

- Offer access to our tools, at the right moments in the process.

These goals presented a few challenges for our designers. The home-buying process is complicated—what’s the right balance between providing enough information so that consumers can be successful without overwhelming them? How do we make it easy for consumers to figure out where they’re currently at in the process? We don’t expect all or even most of our users to come to our website at the very beginning of their home buying journey. And how do we keep this action-oriented, so people can use this guide to take concrete steps on their path toward owning a home?

These were the questions we considered as we designed the first iteration of the tool. We then shared our first design prototype with people currently buying a home to get feedback—and see whether we were successful in meeting our goals.

First iteration of a phase page layout.

First iteration of a phase page layout.

Our early usability testing revealed that our prototype did not include enough information for users to make sense of the process. Users requested more information about what the action steps meant, and wanted our tools and resources to be connected to specific action steps. We also discovered that our navigation wasn’t successful—it took users a long time to notice the phases of the process because we had placed them at the bottom of the page.

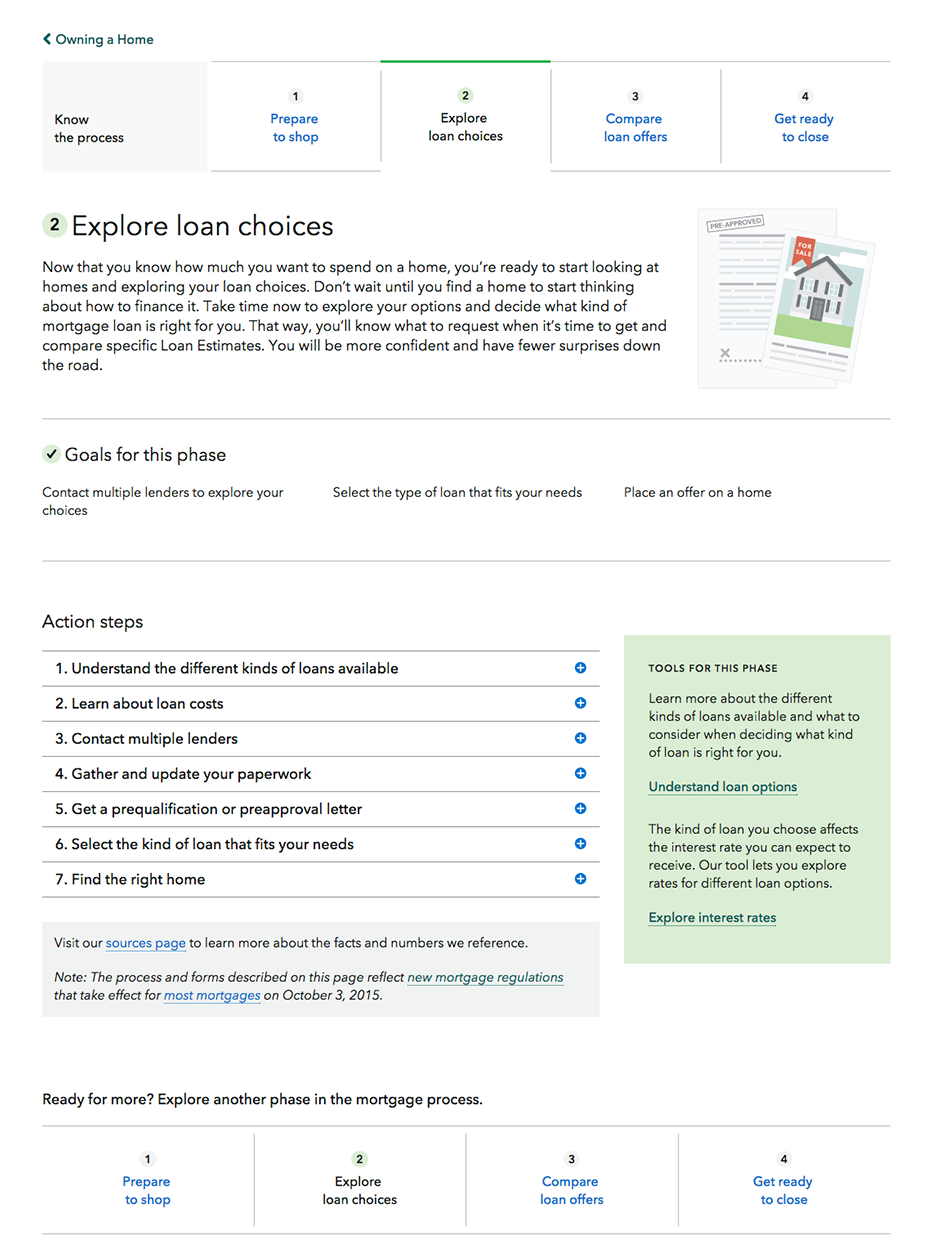

With these problems now defined, we went back to work. We made the action steps expandable, with additional information, so that consumers could selectively dig into the details without being initially overwhelmed. We embedded tools and links into the action steps to connect users with the extensive resources the CFPB has to offer. We duplicated the navigation on the top and bottom of the page, to make it findable and reinforce where a user is currently located within the process.

Final design for a phase page.

Final design for a phase page.

Additional content in the action steps.

Additional content in the action steps.

This new tool will help home buyers throughout the process of buying a home: from the very start through to closing. Phases and action steps help make sure consumers don’t miss anything important, and our interactive tools give home buyers the information they need to feel more confident throughout the entire home-buying process. In addition to this new tool, we’ve added other tools to help consumers use the new Loan Estimate and Closing Disclosure forms and written new content to help consumers use these resources more effectively. Visit the updated site here!